Chapter II: Codex

Objectives

Goal: Leverage our proprietary infrastructure to systematically discover, automate, and scale profitable strategies—and distribute them globally through RAXF.

During World War II, the Germans relied on the Enigma machine for encryption. It resembled a typewriter but hid immense complexity: rotating rotors that scrambled letters differently with each keystroke. Typing “ATTACK AT DAWN” twice would yield two entirely distinct codes. With more than 150 trillion possible combinations, Enigma was believed to be unbreakable.

In many ways, on-chain finance presents a similar challenge—an immense, ever-shifting web of data that seems impossible to decode. Our infrastructure aggregates and normalizes this fragmented landscape—spanning transactions, wallets, smart contracts, and user behavior—into a unified, structured dataset. These standardized inputs form the foundation for advanced AI and machine learning models capable of uncovering profitable trading strategies at scale.

Chapter 2 activates this potential: harnessing the infrastructure from Chapter 1 to identify, automate, and deploy alpha through RAXF, bringing institutional-grade strategies to a global audience.

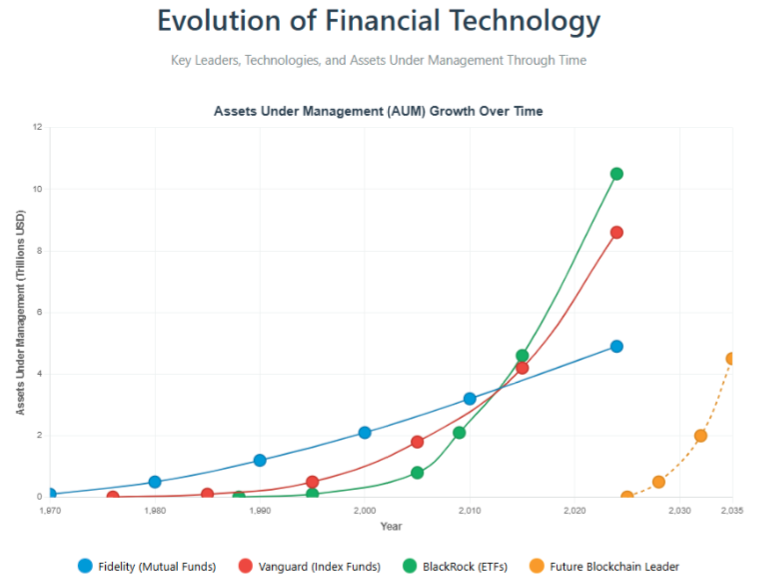

The History of Asset Management—and What the Future Holds

The asset management industry has continuously evolved through technology—each era marked by breakthroughs that made investing more efficient, accessible, and cost-effective:

- 1970s – Mutual Funds: Advances in computing enabled firms like Fidelity to track thousands of securities simultaneously, paving the way for diversified mutual funds. What was once exclusive to institutions became available to retail investors.

- 1980s – Index Funds: Jack Bogle at Vanguard used computing power to replicate entire indices, reducing costs and outperforming most active managers through automation and efficiency.

- 2000s – ETFs: Larry Fink at BlackRock popularized exchange-traded funds, merging diversification with real-time liquidity. Unlike mutual funds, ETFs traded continuously—offering flexibility without sacrificing access.

- 2020s – RAXF: The next transformation is blockchain-native. Smart contracts now enable autonomous, transparent, and virtually costless investment vehicles—operating without intermediaries. The future leaders of asset management will be those who successfully launch blockchain-based funds at scale.

We call them RAXF: Real-Time Automated Exchangeless Funds—investment vehicles that operate continuously, at near-zero cost, with full transparency, and free from the structural constraints of traditional finance.

Just as computers revolutionized portfolio management and the internet ushered in real-time trading, blockchain will automate the entire investment and fund-creation process—reshaping the foundations of global finance.

| Era / Innovation | Years | Leader | Technology | Peak / Current AUM | Description |

|---|---|---|---|---|---|

| Computer-Powered Mutual Funds | 1970s | Fidelity (Edward C. Johnson III) | Computerized Data Processing | ~$4.9 T (2024) | Early advances in computing enabled Fidelity to track thousands of securities efficiently, making diversified mutual fund investing accessible to retail investors for the first time. |

| Automated Index Funds | 1976–1980s | Vanguard (John C. “Jack” Bogle) | Automated Market Replication | ~$8.6 T (2024) | Vanguard pioneered index funds by using automation to mirror entire market indices, eliminating costly active management and proving that simplicity and lower fees could outperform traditional stock picking. |

| Real-Time ETF Trading | 2000s–2009 | BlackRock (Larry Fink) | Electronic Trading Infrastructure | ~$10.5 T (2024) | BlackRock leveraged internet-era trading systems to launch ETFs that combined diversification with real-time liquidity and transparency, transforming global asset distribution. |

| Blockchain-Native Investing | 2020s–Future | To Be Determined | Blockchain & Smart Contracts | $1–5 T (Projected by 2030s) | The next frontier in asset management will be defined by autonomous, blockchain-based investment products that operate continuously, with near-zero fees, full transparency, and no intermediaries. |

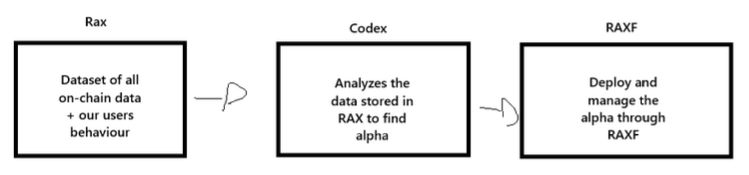

From Data to Deployment

Goal: Leverage our Chapter One infrastructure to discover, automate, and deploy alpha at scale—delivering it to the world through RAXF.

By 2027, Rax will have established a robust infrastructure enabling quantitative researchers to analyze massive on-chain datasets, test complex strategies, and uncover profitable patterns. In this chapter, our goal is to build a fully automated system capable of continuously testing, identifying, and deploying high-performing on-chain funds.

This will be achieved through CodeX. CodeX utilizes our proprietary datasets—spanning blockchain transactions, order flows, liquidity movements, trader behavior, and market microstructure—to rigorously test and validate strategies at scale. Through simulation, stress-testing, and multi-scenario validation, CodeX isolates genuine alpha signals from market noise.

Once identified, RAXF serves as the deployment layer, enabling CodeX to seamlessly launch and manage these strategies as autonomous, on-chain funds. RAXF gives both retail and institutional investors transparent, automated access to cutting-edge strategies through a standardized infrastructure.

Crucially, RAXF is built as an open infrastructure. Beyond our own strategies, any quant, fund manager, or institution will be able to launch and manage their own on-chain funds through RAXF, leveraging the same unified execution, risk management, and investor access framework.

Our objective is not to deploy a single high-performing fund, but to launch hundreds of specialized funds annually, each representing a distinct edge in the market. This systematic approach allows investors to diversify across uncorrelated sources of alpha while RAXF and CodeX continuously handle monitoring, optimization, and rebalancing.