Chapter one: The New World

Objective

Goal: Build a well-structured, open infrastructure that aggregates and organizes all on-chain data.

The financial world is rapidly moving on-chain. This shift means that every financial action—trades, counterparties, sizes, and frequency of interactions—becomes publicly available in real time.

The unprecedented granularity of on-chain data unlocks a new era of algorithmic strategies, enabling traders and investors to identify and exploit market inefficiencies with unmatched precision and speed.

Our thesis is simple: more data, better structured, leads to better returns.

As the world moves on-chain, every trade, transfer, and interaction becomes transparent—unlocking the data needed to uncover alpha, generate superior returns, and share them with you.

The Data Advantage: How Information Access Drives Superior Returns

This graph highlights a paradox in modern finance: even as data accessibility has soared from just 10% in the 1970s to 95% today, the world’s top hedge funds have not only preserved but often expanded their performance edge over the market.

Early legends like George Soros achieved 30%+ returns through superior fundamental analysis and information asymmetry. Today, quantitative powerhouses such as Renaissance Medallion (66% average returns) and Citadel (66% in 2022) achieve extraordinary alpha by combining unprecedented data access with cutting-edge technology.

On-chain finance represents the next leap in this data revolution. Every transaction, wallet movement, and smart contract interaction is transparently recorded and instantly available. With blockchain networks offering 100% data visibility—versus the fragmented view of traditional markets—we believe those who can harness this granular, real-time, and immutable dataset will unlock the next generation of superior returns, potentially surpassing even today’s most legendary data-driven giants.

Interesting thought

Throughout our years in institutional trading, we’ve witnessed every kind of return—good, bad, consistent, and unpredictable. Yet one thing we had never encountered was a trader who never had a losing day. We once believed it was impossible—until we went deep into on-chain markets and observed top performers like Cupsey and others, who consistently avoid losses and achieve Sharpe ratios more than 11 times higher than the best traders in traditional finance.

This new level of performance reveals a larger truth: on-chain trading enables entirely new forms of strategy and return—offering consistency and efficiency that were previously unattainable in traditional markets.

Can these strategies scale to the levels traded by major funds today? Probably not, given current liquidity constraints. But they serve as clear proof that higher, more data-driven returns are not only possible—they are already being achieved.

The Plan

Unlike what you might expect, we’re only a team of two. Fully self-funded, with backgrounds as successful entrepreneurs in different fields. I’m a former institutional trader; 0x is the smartest engineer I know. In just 4 months of development, we built every component from the ground up—no third-party dependencies—optimized for latency. Our system already handles 16M operations per second with sub-millisecond end-to-end latency, and 0x is on track to push this to sub-millisecond within the next 6 months.

But how do two people compete against firms with budgets larger than the GDP of small countries?

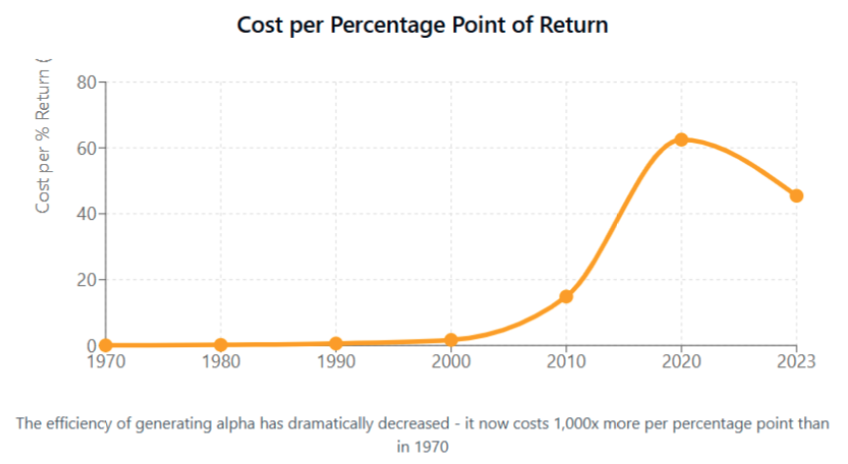

The escalating cost of alpha generation stems from a decades-long technological arms race that has reshaped finance. In the 1970s, superior returns came from basic information advantages—better research, faster phone calls, or privileged access to management. A small team with minimal infrastructure could deliver 30%+ returns.

As markets grew more efficient, the edge shifted to speed and data. Each leap drove up costs: Bloomberg terminals in the 1980s, high-frequency trading with millions spent on co-location in the 2000s, and today’s AI-driven strategies demanding hundreds of millions in GPUs and alternative data sources like satellite imagery.

The result? Generating each incremental percentage point of return now costs 1,000x more than in 1970.

So how can we compete against these giants? The answer is simple: you.

What we’ve built isn’t just a trading engine—it’s an open infrastructure that lets you perform high-precision analysis and automate alpha. What you see on Rax is only a suggestion. The possibilities are limitless and defined by your creativity. You can build dashboards, charts, and indicators directly within Rax. We’re simply the layer between you and the blockchain.

The only way to outperform 1,000 quants is to create a platform that attracts 10,000 of them—and let them discover where the alpha truly lies. This approach gives us the most comprehensive database of what works (and what doesn’t) in the market.

Chapter 1 focuses on aggregating on-chain data—both from markets and users—and packaging it into a structured format.

Chapter 2: Codex will take that foundation and use our proprietary dataset to repeatedly uncover highly profitable strategies, deploying them so the world can invest in them.